Page 96 - InterEnergo - Annual Report 2020

P. 96

Interenergo Accounting report Interenergo Accounting report

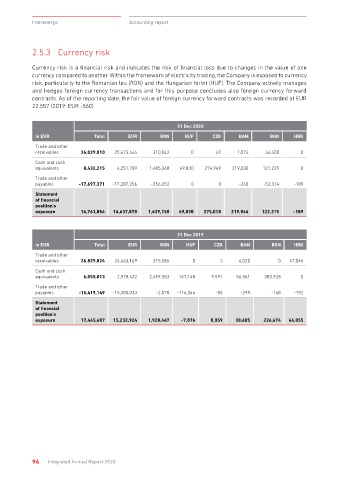

2.5.3 Currency risk 2.5.4 Interest rate risk

Currency risk is a financial risk and indicates the risk of financial loss due to changes in the value of one Interest rate risk means the possibility of loss due to adverse interest rate movements on the market. The

currency compared to another. Within the framework of electricity trading, the Company is exposed to currency Company is financed based on non-current borrowings bearing a fixed interest rate from the parent company,

risk, particularly to the Romanian leu (RON) and the Hungarian forint (HUF). The Company actively manages and is exposed to interest rate risk when using bank overdrafts at commercial banks for the purpose of financing

and hedges foreign currency transactions and for this purpose concludes also foreign currency forward temporary liquidity gaps. Variable interest rates are based on Euribor and Euro-Libor.

contracts. As of the reporting date, the fair value of foreign currency forward contracts was recorded at EUR

22,557 (2019: EUR -560).

in EUR 31 Dec 2020 31 Dec 2019

Instruments bearing the fixed interest rate 205,991 19,616,810

31 Dec 2020

Non-current loans granted 63,133,181 43,439,876

in EUR Total EUR RON HUF CZK BAM BGN HRK

Non-current borrowings -60,427,190 -23,823,066

Trade and other

receivables 26,029,010 25,673,444 310,042 0 49 1,074 44,400 0 Current borrowings -2,500,000 0

Cash and cash Instruments bearing a variable interest rate -1,297 -1,743,154

equivalents 8,432,215 6,251,789 1,485,368 69,830 274,969 219,030 131,229 0

Current borrowings -1,297 -1,743,154

Trade and other

payables -17,697,371 -17,287,356 -356,252 0 0 -260 -53,314 -189

Statement 2.5.5 Price risk

of financial

position's Price risk is a type of market risk that arises from unfavourable movements in electricity prices on the markets

exposure 16,763,854 14,637,878 1,439,158 69,830 275,018 219,844 122,315 -189

and has a negative impact on the value of open commodity forward contracts and consequently a negative

effect on business operations. Concluded and not yet delivered electricity forward contracts and cross-border

transmission capacity contracts are exposed to price risk is exposed to. The mark-to-market (MtM) value of

31 Dec 2019

open commodity forward contracts is estimated daily on the basis of the relevant hourly price forward curves

in EUR Total EUR RON HUF CZK BAM BGN HRK (HPFCs) derived from stock prices, whereas transactions related to cross-border transmission capacities are

Trade and other based on differences between the relevant forward price curves. A risk management system based on the

receivables 26,829,824 26,463,169 315,586 0 3 4,020 0 47,046 value-at-risk model (VaR) has also been established. The latter enables that the risk measures of the concluded

Cash and cash contracts are valued by different portfolios, markets and strategies for which pre-defined maximum exposure

equivalents 6,055,013 2,978,432 2,459,353 167,148 9,591 56,561 383,928 0 limits are defined.

Trade and other A sensitivity analysis of the change in prices showed that in the event of a general price change of 10%, the

payables -15,419,149 -15,300,033 -2,078 -116,344 -55 -299 -148 -192

fair value of open commodity forward contracts and cross-border transmission capacity contracts would

Statement change by EUR 664,103.

of financial

position's

exposure 17,465,687 15,232,924 1,920,447 -7,876 8,059 38,605 226,674 46,855 2.5.6 Carrying amounts and fair values of financial instruments

Financial instruments are classified to three levels according to the verifiability of the input data for the

calculation of their fair value. Derivatives consist of:

• Standardized futures contracts, whose fair values are valued based on the market prices of the relevant

European Energy Exchange (EEX) products on the last active trading day;

• commodity forward contracts and cross-border transmission capacity contracts, whose fair values are

valued on the basis of the market prices of annual products on the European Energy Exchange (EEX) on

the last active trading day;

• foreign currency forward contracts, whose fair values are valued on the basis of market exchange rates

and differences in market interest rates.

94 Integrated Annual Report 2020 Integrated Annual Report 2020 95