Page 91 - InterEnergo - Annual Report 2020

P. 91

Interenergo Accounting report Interenergo Accounting report

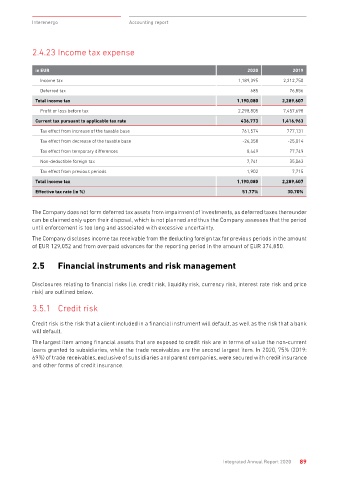

2.4.20 Amortisation and depreciation expense 2.4.23 Income tax expense

in EUR 2020 2019

in EUR 2020 2019

Income tax 1,189,395 2,212,750

Amortisation and depreciation expense -1,029,100 -795,352

Deferred tax 685 76,856

Amortisation of intangible assets -156,735 -127,491

Total income tax 1,190,080 2,289,607

Depreciation of property, plant and equipment -181,258 -164,786

Profit or loss before tax 2,298,805 7,457,698

Amortisation of the right of use the assets -691,107 -503,075

Current tax pursuant to applicable tax rate 436,773 1,416,963

2.4.21 Other operating expenses Tax effect from increase of the taxable base 761,574 777,131

Tax effect from decrease of the taxable base -26,358 -25,014

Tax effect from temporary differences 8,449 77,749

in EUR 2020 2019

Non-deductible foreign tax 7,741 35,063

Other operating expenses -175,169 -39,120

Tax effect from previous periods 1,902 7,715

Charges and other levies -24,055 -20,931

Total income tax 1,190,080 2,289,607

Net foreign exchange losses -129,576 -9,312

Effective tax rate (in %) 51.77% 30.70%

Other costs -21,538 -8,877

The Company does not form deferred tax assets from impairment of investments, as deferred taxes thereunder

2.4.22 Operating result from financing activites can be claimed only upon their disposal, which is not planned and thus the Company assesses that the period

until enforcement is too long and associated with excessive uncertainty.

in EUR 2020 2019 The Company discloses income tax receivable from the deducting foreign tax for previous periods in the amount

of EUR 129,052 and from overpaid advances for the reporting period in the amount of EUR 374,850.

Finance income 3,207,835 2,983,328

Finance income on interests and loans to subsidiaries 3,204,559 2,979,989

2.5 Financial instruments and risk management

Other finance income 3,276 3,339

Finance costs -5,250,183 -4,980,129

Disclosures relating to financial risks (i.e. credit risk, liquidity risk, currency risk, interest rate risk and price

Costs of impairment of investments -3,906,237 -3,949,349 risk) are outlined below.

Costs of borrowings from the parent company -1,215,047 -861,400

3.5.1 Credit risk

Finance costs of loans from others -72,206 -76,828

Net foreign currency exchange losses -52,592 -88,930 Credit risk is the risk that a client included in a financial instrument will default, as well as the risk that a bank

Finance lease expenses -4,102 -3,622 will default.

Operating result from financing activities -2,042,348 -1,996,801 The largest item among financial assets that are exposed to credit risk are in terms of value the non-current

loans granted to subsidiaries, while the trade receivables are the second largest item. In 2020, 75% (2019:

69%) of trade receivables, exclusive of subsidiaries and parent companies, were secured with credit insurance

Finance costs for impairment of investments refer to the impairment of an investment in the amount of EUR and other forms of credit insurance.

3,906,237 (Notes 2.4.3.1 and 2.4.3.2).

88 Integrated Annual Report 2020 Integrated Annual Report 2020 89