Page 95 - InterEnergo - Annual Report 2020

P. 95

Interenergo Accounting report Interenergo Accounting report

Movement of allowances for receivables, contract assets and other assets 2.5.2 Liquidity risk

in EUR 31 Dec 2020 31 Dec 2019 Liquidity risk is the financial risk associated with the Company’s liquidity. Liquidity risk is the risk of a mismatch

between Company’s matured assets and liabilities. Liquidity risk indicates the possibility of a lack of cash to

Balance at 1 Jan -796,731 -792,034

repay overdue liabilities

Formation of allowances 0 -4,697

The Company in engaged in an active and on-going monitoring of liquidity and planning of all cash flows. In

Reversal of allowances 1,199 0

2019 and 2020, the Company settled its liabilities without any delays.

Write-off of receivables 8,659 0

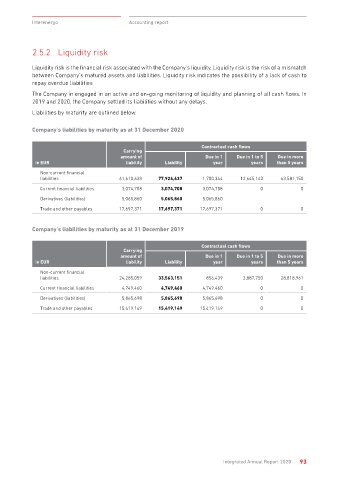

Liabilities by maturity are outlined below.

Balance at 31 Dec -786,873 -796,731

Company’s liabilities by maturity as at 31 December 2020

Impairment of loans granted

Contractual cash flows

Carrying

The credit quality of loans granted to Group companies, measured at amortised cost, is presented below i.e. amount of Due in 1 Due in 1 to 5 Due in more

for granted loans that were subject to impairment assessment including investments in subsidiaries, and for in EUR liability Liability year years than 5 years

loans that were not subject to impairment assessment including investments in subsidiaries. By checking the Non-current financial

impairment of investments in subsidiaries, the Company also checks the impairment of loans. In this case, the liabilities 61,610,638 77,926,637 1,700,344 12,645,143 63,581,150

impairment value is recognized as the difference between the carrying amount and the expected contractual

cash flows, discounted at the initial effective interest rate. Current financial liabilities 3,074,708 3,074,708 3,074,708 0 0

Derivatives (liabilities) 5,065,860 5,065,860 5,065,860

Trade and other payables 17,697,371 17,697,371 17,697,371 0 0

in EUR Gross value Expected credit loss

Granted loans subject to impairment testing 37,703,578 -3,687,475

Company’s liabilities by maturity as at 31 December 2019

Granted loans not subject to impairment testing 29,422,732 0

Total 67,126,310 -3,687,475

Contractual cash flows

Carrying

amount of Due in 1 Due in 1 to 5 Due in more

Movement of allowances for loans granted in EUR liability Liability year years than 5 years

Non-current financial

in EUR 31 Dec 2020 31 Dec 2019 liabilities 24,285,059 33,563,151 856,439 3,887,750 28,818,961

Balance at 1 Jan -8,913,028 -8,996,634 Current financial liabilities 4,749,460 4,749,460 4,749,460 0 0

Formation of allowances 0 -1,464,964 Derivatives (liabilities) 5,865,698 5,865,698 5,865,698 0 0

Transfer of allowances to investments 5,225,554 1,548,570 Trade and other payables 15,419,149 15,419,149 15,419,149 0 0

Balance at 31 Dec -3,687,475 -8,913,028

Cash and cash equivalents

The value of cash and cash equivalents amounted as at 31 December 2020 to EUR 8,432,215 (2019: EUR

6,055,013). Cash and cash equivalents are invested with first-class banks with the highest credit rating according

to the company’s internal valuation.

Impairment of cash and cash equivalents was measured based on a 12-month expected credit loss, reflecting

the short-term maturity of the instrument and the short-term exposure of the Company. Based on the credit

ratings of banks, the Company estimates that cash and cash equivalents have a low credit risk, and impairment

was recognised in the amount of EUR 1,497 on 31 December 2020.

92 Integrated Annual Report 2020 Integrated Annual Report 2020 93