Page 93 - InterEnergo - Annual Report 2020

P. 93

Interenergo Accounting report Interenergo Accounting report

The carrying amount of financial assets represents the maximum exposure to credit risk, and at the reporting in EUR 31 Dec 2020 31 Dec 2019

date amounted as follows:

Impairment of trade receivables, contract assets and other assets, recognised in the

income statement 1,103 4,697

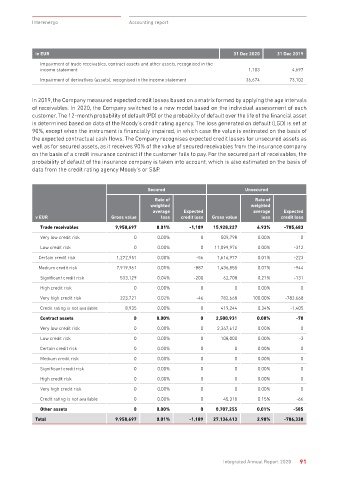

in EUR 31 Dec 2020 31 Dec 2019 Impairment of derivatives (assets), recognised in the income statement 36,674 73,102

Non-current loans granted 63,133,181 43,439,876

Non-current receivables 55,453 59,130 In 2019, the Company measured expected credit losses based on a matrix formed by applying the age intervals

Current investments 4,593,239 3,110,672 of receivables. In 2020, the Company switched to a new model based on the individual assessment of each

customer. The 12-month probability of default (PD) or the probability of default over the life of the financial asset

Derivatives (assets) 5,293,775 8,389,941

is determined based on data of the Moody’s credit rating agency. The loss generated on default (LGD) is set at

Trade receivables 25,031,786 25,380,082 90%, except when the instrument is financially impaired, in which case the value is estimated on the basis of

Cash and cash equivalents 8,432,215 6,055,013 the expected contractual cash flows. The Company recognises expected credit losses for unsecured assets as

well as for secured assets, as it receives 90% of the value of secured receivables from the insurance company

Total 106,539,648 86,434,714

on the basis of a credit insurance contract if the customer fails to pay. For the secured part of receivables, the

probability of default of the insurance company is taken into account, which is also estimated on the basis of

Impairment of trade receivables, contract assets and derivatives (assets) data from the credit rating agency Moody’s or S&P.

As part of the credit risk management process, the Company determines credit limits for customers based

on credit ratings of internationally recognized credit rating agencies (Moody’s) and internal creditworthiness Secured Unsecured

testing. Based on internally adopted policies, the risk management department analyses and classifies the Rate of Rate of

customer into one of seven credit rating classes before starting business operations and checks the possibility weighted Expected weighted Expected

average

average

of assigning a credit limit to the insurance company, on the basis of which customer’s receivables are included v EUR Gross value loss credit loss Gross value loss credit loss

in credit insurance. Approved limits are checked and supplemented on an ongoing basis. The ratings of all Trade receivables 9,958,697 0.01% -1,189 15,928,227 4.93% -785,683

customers are updated annually. A review of customer credit assessment procedures is also carried out on

an annual basis and a formal opinion on compliance is obtained. Very low credit risk 0 0.00% 0 509,798 0.00% 0

Customers are ranked in seven credit rating classes: Low credit risk 0 0.00% 0 11,099,976 0.00% -312

Certain credit risk 1,272,951 0.00% -56 1,616,977 0.01% -223

• Class 1 (very good credit rating - very low credit risk), equivalent to Moody’s credit ratings from Aaa to A2;

Medium credit risk 7,919,961 0.01% -887 1,436,855 0.07% -944

• Class 2 (high credit rating - low credit risk), equivalent to Moody’s A3 credit rating;

Significant credit risk 533,129 0.04% -200 62,708 0.21% -131

• Class 3 (good credit rating - certain credit risk), equivalent to Moody’s credit ratings from Baa1 to Baa3;

High credit risk 0 0.00% 0 0 0.00% 0

• Class 4 (medium credit rating - medium credit risk), equivalent to Moody’s credit ratings from Ba1 to Ba3;

Very high credit risk 223,721 0.02% -46 782,668 100.00% -782,668

• Class 5 (speculative credit rating - significant credit risk), equivalent to Moody’s credit ratings from B1 to Credit rating is not available 8,935 0.00% 0 419,244 0.34% -1,405

B3;

Contract assets 0 0.00% 0 2,500,931 0.00% -70

• Class 6 (low credit rating - high credit risk), equivalent to Moody’s credit rating Caa1;

Very low credit risk 0 0.00% 0 2,347,612 0.00% 0

• Class 7 (very low credit rating - very high credit risk), equivalent to Moody’s credit ratings from Caa2 to C.

Low credit risk 0 0.00% 0 108,000 0.00% -3

Transactions are concluded only with customers classified within the credit rating Class 3 (good credit rating) Certain credit risk 0 0.00% 0 0 0.00% 0

and higher, which represents a credit rating of Baa3 and higher according to Moody’s. Trading with partners

in lower classes is possible in cases where they provide additional collateral, such as corporate guarantees, Medium credit risk 0 0.00% 0 0 0.00% 0

bank guarantees, deposits or other forms of collateral that can significantly reduce the credit risk of the buyer. Significant credit risk 0 0.00% 0 0 0.00% 0

High credit risk 0 0.00% 0 0 0.00% 0

Very high credit risk 0 0.00% 0 0 0.00% 0

Credit rating is not available 0 0.00% 0 45,318 0.15% -66

Other assets 0 0.00% 0 8,707,255 0.01% -585

Total 9,958,697 0.01% -1,189 27,136,413 2.90% -786,338

90 Integrated Annual Report 2020 Integrated Annual Report 2020 91