Page 86 - InterEnergo - Annual Report 2020

P. 86

Interenergo Accounting report Interenergo Accounting report

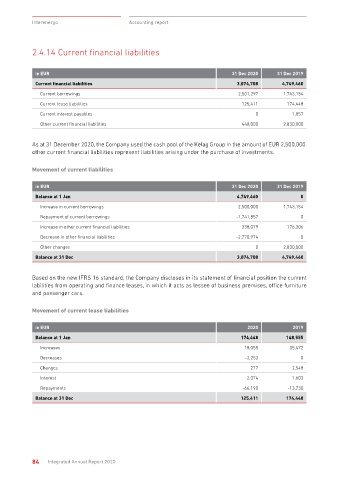

2.4.14 Current financial liabilities 2.4.15 Trade and other payables

in EUR 31 Dec 2020 31 Dec 2019 in EUR 31 Dec 2020 31 Dec 2019

Current financial liabilities 3,074,708 4,749,460 Trade and other payables 17,697,371 15,419,149

Current borrowings 2,501,297 1,743,154 Trade payables to domestic suppliers 391,202 1,125,273

Current lease liabilities 125,411 174,448 Trade payables to foreign suppliers 7,030,583 4,664,532

Current interest payables 0 1,857 Liabilities to related entities 6,242,463 3,096,188

Other current financial liabilities 448,000 2,830,000 Liabilities for received prepayments and collaterals 367,325 100,000

Payables to employees 94,240 84,017

As at 31 December 2020, the Company used the cash pool of the Kelag Group in the amount of EUR 2,500,000. Tax payables and payables for contributions 931,593 65,958

other current financial liabilities represent liabilities arising under the purchase of investments. Other payables 2,639,963 6,283,182

Movement of current liabilities

Current trade payables to suppliers include payables referring to the purchase of electricity and the related

costs in December 2020. Trade receivables to customers and trade payables to suppliers relating to electricity

in EUR 31 Dec 2020 31 Dec 2019

trading can be set off in accordance with provisions of the standard EFET agreement. The set-offs comprise

Balance at 1 Jan 4,749,460 0 receivables to domestic, foreign and related suppliers, who on the other hand act also as buyers.

Increase in current borrowings 2,500,000 1,743,154 Company’s other payables comprise mostly short-term accrued costs for electricity purchased, cross-border

Repayment of current borrowings -1,741,857 0 transmission capacities and the related costs of trading for December 2020. The Company has deferred costs

based on the confirmed contracts on the sale of electricity including delivery in December 2020. Purchases

Increase in other current financial liabilities 338,079 176,306

recorded on power exchanges declined in the reporting period over the last year’s comparable period, thus

Decrease in other financial liabilities -2,770,974 0

the value of accrued costs hereunder is lower.

Other changes 0 2,830,000

Balance at 31 Dec 3,074,708 4,749,460 2.4.16 Revenue

Based on the new IFRS 16 standard, the Company discloses in its statement of financial position the current in EUR 2020 2019

labilities from operating and finance leases, in which it acts as lessee of business premises, office furniture

and passenger cars. Revenue 458,898,377 699,298,011

Revenue from contracts with customers, recognised gradually 455,913,471 696,760,852

Movement of current lease liabilities Revenue from electricity trading 450,351,059 692,885,205

Revenue from sale of electricity produced 520,904 536,429

in EUR 2020 2019

Revenue from commission services 3,178,523 1,770,785

Balance at 1 Jan 174,448 148,555

Revenue from sale of other services 1,862,985 1,568,432

Increases 18,055 35,472

Fair value of commodity forward contracts -2,286,687 2,537,159

Decreases -3,253 0

Effects of standardized futures contracts 5,271,592 0

Changes 277 2,548

Interest 2,074 1,603

Relative to the previous year, Company’s revenue from electricity trading declined by 35%, which is mainly

Repayments -66,190 -13,730 due to the transferred part of Company’s electricity trading from the physical market to the financial market,

Balance at 31 Dec 125,411 174,448 where it trades in standardized futures contracts on the EEX, and revenue and expenses thereunder are shown

in Company’s financial statements at netted amount.

84 Integrated Annual Report 2020 Integrated Annual Report 2020 85