Page 82 - InterEnergo - Annual Report 2020

P. 82

Interenergo Accounting report Interenergo Accounting report

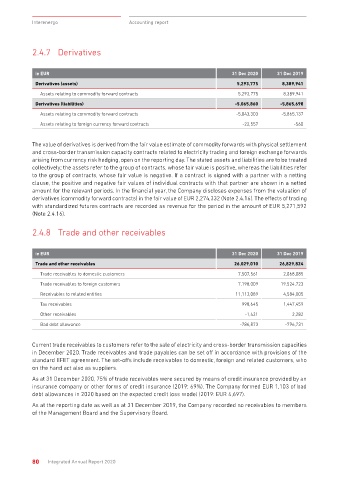

2.4.7 Derivatives 2.4.9 Prepayments, contract assets and other assets

in EUR 31 Dec 2020 31 Dec 2019 in EUR 31 Dec 2020 31 Dec 2019

Derivatives (assets) 5,293,775 8,389,941 Prepayments, contract assets and other assets 11,695,507 7,437,375

Assets relating to commodity forward contracts 5,293,775 8,389,941 Prepayments 8,694,142 4,040,445

Derivatives (liabilities) -5,065,860 -5,865,698 Contract assets 2,500,931 2,877,577

Assets relating to commodity forward contracts -5,043,303 -5,865,137 Other assets 500,435 519,353

Assets relating to foreign currency forward contracts -22,557 -560

Receivables for prepayments refer to advance payment made on the basis of electricity purchase contracts

The value of derivatives is derived from the fair value estimate of commodity forwards with physical settlement and guarantees provided for trading at European energy exchanges. Their value depends on the volume of

and cross-border transmission capacity contracts related to electricity trading and foreign exchange forwards electricity purchased at individual energy exchanges in the respective period; relative to December 2019, more

arising from currency risk hedging, open on the reporting day. The stated assets and liabilities are to be treated purchases of electricity at energy exchanges were recorded in December 2020, which resulted also in higher

collectively; the assets refer to the group of contracts, whose fair value is positive, whereas the liabilities refer relevant receivables.

to the group of contracts, whose fair value is negative. If a contract is signed with a partner with a netting Other assets refer to short-term deferred operating costs, primarily to the purchase of cross-border transmission

clause, the positive and negative fair values of individual contracts with that partner are shown in a netted capacities, annual memberships, subscriptions and insurances.

amount for the relevant periods. In the financial year, the Company discloses expenses from the valuation of

derivatives (commodity forward contracts) in the fair value of EUR 2,274,332 (Note 2.4.16). The effects of trading Contract assets relate to Company’s rights to compensation for performance obligations fulfilled under

contracts with customers. Contract assets are transferred to receivables when the right to payment becomes

with standardized futures contracts are recorded as revenue for the period in the amount of EUR 5,271,592

(Note 2.4.16). unconditional, but after time period elapses. This occurs when the Company issues an invoice to the customer

in accordance with the billing specifics agreed in the contract. Contract assets refer to non-charged sale of

goods and service as the Company deferred accrued income from the December electricity sale at the year-

2.4.8 Trade and other receivables end of 2020, which primarily relate to the electricity sales on power exchanges and sales of cross-border

transmission capacities in December 2020. The value of income is based on the confirmed contracts on the

sale of electricity including delivery in December 2020.

in EUR 31 Dec 2020 31 Dec 2019

Trade and other receivables 26,029,010 26,829,824 Contract balances relating to contracts with customers

Trade receivables to domestic customers 7,507,561 2,068,085

Trade receivables to foreign customers 7,198,009 19,524,723 in EUR 31 Dec 2020 31 Dec 2019

Receivables to related entities 11,113,089 4,584,005 Receivables include in 'Trade and other receivables' 25,818,658 26,176,813

Tax receivables 998,645 1,447,459 Contract assets included in 'Prepayments, contract assets and other assets' 2,500,931 2,877,577

Other receivables -1,421 2,282 Contract liabilities included in 'Trade and other payables' 0 0

Bad debt allowance -786,873 -796,731

Changes in the value of contract assets

Current trade receivables to customers refer to the sale of electricity and cross-border transmission capacities

in December 2020. Trade receivables and trade payables can be set off in accordance with provisions of the in EUR 2020 2019

standard EFET agreement. The set-offs include receivables to domestic, foreign and related customers, who Balance at 1 Jan 2,877,577 8,957,024

on the hand act also as suppliers.

Increase 2,500,931 2,877,577

As at 31 December 2020, 75% of trade receivables were secured by means of credit insurance provided by an Transfer to receivables -2,877,577 -8,957,024

insurance company or other forms of credit insurance (2019: 69%). The Company formed EUR 1,103 of bad

debt allowances in 2020 based on the expected credit loss model (2019: EUR 4,697). (Recognition) / Reversal of impairment -70 0

Balance at 31 Dec 2,500,861 2,877,577

As at the reporting date as well as at 31 December 2019, the Company recorded no receivables to members

of the Management Board and the Supervisory Board.

80 Integrated Annual Report 2020 Integrated Annual Report 2020 81