Page 78 - InterEnergo - Annual Report 2020

P. 78

Interenergo Accounting report Interenergo Accounting report

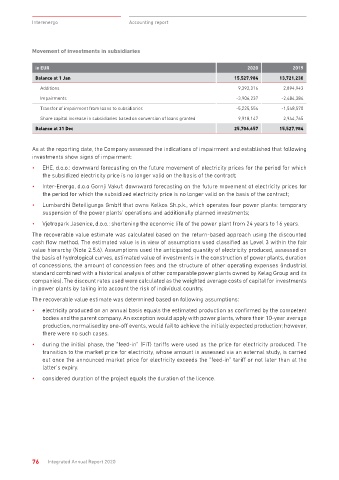

Movement of investments in subsidiaries Impairment testing was carried out on 31 December 2020 based on the present value method of expected

cash flows. The significant assumptions used for individual investments are shown in the table below.

in EUR 2020 2019

Balance at 1 Jan 15,527,984 13,721,230

Additions 9,392,316 2,894,943

Impairments -3,906,237 -2,484,384 Production period ill year

Transfer of impairment from loans to subsidiaries -5,225,554 -1,548,570 Cash generating unit Discount rate (WACC) Average annual production of electricity Initial market purchase price in EUR/MWh* Period of market prices Value of investments and loans granted ** prior to impairment Estimate of recoverable investments recognised in income statement

Share capital increase in subsidiaries based on conversion of loans granted 9,918,147 2,944,765 in MWh FIT period amount Impairment of

Balance at 31 Dec 25,706,657 15,527,984 Investment (CGU) in %

CGU1 9.00% 10,500 2046 2021-2031 59.35 2031-2046

As at the reporting date, the Company assessed the indications of impairment and established that following EHE d.o.o. CGU2 9.00% 17,000 2056 2021-2028 56.34 2028-2056 26,597,624 26,430,360 -167,263

investments show signs of impairment: CGU3 9.00% 20,000 2056 2021-2031 59.40 2032-2056

• EHE, d.o.o.: downward forecasting on the future movement of electricity prices for the period for which Inter- CGU1 8.80% 3,800 2035 - 51.97 2021-2035

the subsidized electricity price is no longer valid on the basis of the contract; Energo d.o.o 2,667,530 4,360,522 0

Gornji Vakuf CGU2 8.80% 8,600 2042 2021-2027 56.64 2027-2042

• Inter-Energo, d.o.o Gornji Vakuf: downward forecasting on the future movement of electricity prices for CGU1 9.00% 25,000 2056 - 51.97 2021-2056

the period for which the subsidized electricity price is no longer valid on the basis of the contract;

Lumbardhi CGU2 9.05% 20,000 2069 2021-2026 54.82 2026-2069

• Lumbardhi Beteiligungs GmbH that owns Kelkos Sh.p.k., which operates four power plants: temporary GmbH 7,531,500 3,408,691 4,122,809

suspension of the power plants’ operations and additionally planned investments; CGU3 9.05% 29,500 2069 2021-2026 54.82 2026-2069

CGU4 9.05% 14,000 2069 2021-2029 58.40 2030-2069

• Vjetropark Jasenice, d.o.o.: shortening the economic life of the power plant from 24 years to 16 years.

Vjetropark

The recoverable value estimate was calculated based on the return-based approach using the discounted Jasenice CGU1 5.70% 21,500 2035 2021-2033 62.00 2034-2035 13,953,079 17,641,168 0

cash flow method. The estimated value is in view of assumptions used classified as Level 3 within the fair d.o.o.

value hierarchy (Note 2.5.6). Assumptions used the anticipated quantity of electricity produced, assessed on

the basis of hydrological curves, estimated value of investments in the construction of power plants, duration * Market prices are based on the stock exchange prices of standardized futures contracts on the HUPX stock exchange for the 2021–2024 period; upon that period,

of concessions, the amount of concession fees and the structure of other operating expenses (industrial the RWE study is the source of long-term forecasts of market price movements.

** Inclusive of long-term and short-term loans and interest receivables.

standard combined with a historical analysis of other comparable power plants owned by Kelag Group and its

companies). The discount rates used were calculated as the weighted average costs of capital for investments

in power plants by taking into account the risk of individual country. While the calculation method remained the same – relative to the impairment-related estimates made by the

Company last year – the key change in this year’s impairment assumptions was the general lowering of the

The recoverable value estimate was determined based on following assumptions: electricity price level in the price forecasting study and emergencies related to unforeseen activities by state

• electricity produced on an annual basis equals the estimated production as confirmed by the competent bodies in Kosovo, due to which the operation of power plants has been partially curtailed. At the same time,

bodies and the parent company. An exception would apply with power plants, where their 10-year average the need for impairment also resulted from the share capital increases.

production, normalised by one-off events, would fail to achieve the initially expected production; however, The Company is of the opinion that the stated changes in assumptions contribute to a more accurate and realistic

there were no such cases. valuation of non-current investments in subsidiaries. In view of the results of the performed analysis, which

• during the initial phase, the “feed-in” (FiT) tariffs were used as the price for electricity produced. The included the aforesaid changes in assumptions, the Company impaired the investments in EHE, d.o.o. (in the

transition to the market price for electricity, whose amount is assessed via an external study, is carried amount of EUR 976,383, whereof EUR 167,976 refers to impairment and EUR 808,406 to transfer of impairment

out once the announced market price for electricity exceeds the “feed-in” tariff or not later than at the from ‘loans’ to ‘investments’) and investments in Lumbardhi Beteiligungs GmbH (EUR 3,738,260). Within the

latter’s expiry. conversion of the loan into equity of EHE, d.o.o., the Company also transferred the relevant impairment of the

loan over to the investment (EUR 4,417,148).

• considered duration of the project equals the duration of the licence.

The Management assesses that the key assumptions for estimating the recoverable amount of investments

are the quantity of electricity production and the weighted average cost of capital. The sensitivity analysis of

the recoverable amount to changes in the projected amount of electricity production and the weighted average

cost of capital is shown in the table below.

76 Integrated Annual Report 2020 Integrated Annual Report 2020 77