Page 80 - InterEnergo - Annual Report 2020

P. 80

Interenergo Accounting report Interenergo Accounting report

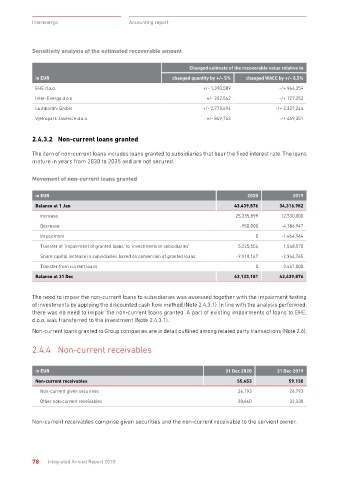

Sensitivity analysis of the estimated recoverable amount 2.4.5 Deferred tax assets

Changed estimate of the recoverable value relative to

in EUR 31 Dec 2020 31 Dec 2019

in EUR changed quantity by +/- 5% changed WACC by +/- 0,5%

Deferred tax assets 163,483 164,168

EHE d.o.o. +/- 1,390,589 -/+ 966,354

from impairment of operating receivables 149,915 158,154

Inter-Energo d.o.o. +/- 282,542 -/+ 127,252

from temporary differences arising on useful lives of

Lumbardhi GmbH +/- 2,773,694 -/+ 2,327,244 property, plant and equipment 13,568 6,014

Vjetropark Jasenice d.o.o. +/- 849,763 -/+ 449,351

Movement of deferred tax assets

2.4.3.2 Non-current loans granted

Impairment of Useful life of

The item of non-current loans includes loans granted to subsidiaries that bear the fixed interest rate. The loans in EUR receivables fixed assets Total

mature in years from 2030 to 2035 and are not secured. Balance at 1 Jan 158,154 6,014 164,168

Change in the income statement -8,239 7,554 -685

Movement of non-current loans granted

Balance at 31 Dec 149,915 13,568 163,483

in EUR 2020 2019

Balance at 1 Jan 43,439,876 34,316,982 2.4.6 Current investments

Increase 25,335,899 12,730,000

Decrease -950,000 -4,186,947 in EUR 31 Dec 2020 31 Dec 2019

Impairment 0 -1,464,964 Current investments 4,593,239 3,110,672

Transfer of ‘impairment of granted loans’ to ‘investments in subsidiaries’ 5,225,554 1,548,570 Current loans to subsidiaries 305,655 83,655

Share capital increase in subsidiaries based on conversion of granted loans -9,918,147 -2,944,765 Current interest receivables from loans 4,287,584 3,027,017

Transfer from current loans 0 3,441,000

Balance at 31 Dec 63,133,181 43,439,876 Short-term investments comprise loans granted to subsidiaries and the value of interest receivables from

loans that fall due in the period of up to 1 year.

The need to impair the non-current loans to subsidiaries was assessed together with the impairment testing

of investments by applying the discounted cash flow method (Note 2.4.3.1). In line with the analysis performed, Movement of current investments

there was no need to impair the non-current loans granted. A part of existing impairments of loans to EHE,

d.o.o. was transferred to the investment (Note 2.4.3.1). in EUR 2020 2019

Non-current loans granted to Group companies are in detail outlined among related party transactions (Note 2.6). Balance at 1 Jan 3,110,671 6,519,035

Increase in current loans granted 222,000 80,655

2.4.4 Non-current receivables Repayment of current loans granted 0 -14,000

Transfer to non-current loans 0 -3,441,000

in EUR 31 Dec 2020 31 Dec 2019 Increase in interest receivables 3,204,559 2,979,989

Non-current receivables 55,453 59,130 Decrease in interest receivables -1,943,991 -3,014,007

Non-current given securities 26,793 26,793 Balance at 31 Dec 4,593,239 3,110,671

Other non-current receivables 28,660 32,338

Non-current receivables comprise given securities and the non-current receivable to the servient owner.

78 Integrated Annual Report 2020 Integrated Annual Report 2020 79