Page 72 - InterEnergo - Annual Report 2020

P. 72

Interenergo Accounting report Interenergo Accounting report

Statement of cash flows Movement in intangible assets for 2020

The statement of cash flows is a fundamental financial statement showing a true and fair view of changes in Long-term Intangible assets Other intangible

cash and cash equivalents during a financial year. The statement of cash flows is prepared by using the indirect in EUR property rights in acquisition assets Total

method in accordance with IFRS. The cash flow statement includes cash flows from operating, investing and Purchase cost

financing activities. Cash flows are generally not presented in set-off amounts. The statement of cash flows

includes data taken from the statement of financial position and the statement of profit or loss by considering Balance at 1 Jan 2020 870,101 74,629 0 944,730

also appropriate adjustments for cash flows. Additions 60,725 63,229 0 123,953

Transfer 125,853 -125,853 0 0

New standards and interpretations and amendments to applicable standards

Balance at 31 Dec 2020 1,056,678 12,005 0 1,068,683

Certain new accounting standards and interpretations have been published, which are not mandatory for the Accumulated amortisation

reporting periods as of 31 December 2020 and have not been adopted by the Company prematurely. These Balance at 1 Jan 2020 -515,265 0 0 -515,265

standards are not expected to have a material impact on the Company in the short or future reporting periods

and on foreseeable future transactions: Amortisation -156,735 0 0 -156,735

• Onerous Contracts – Costs of Fulfilling a Contract (amendments to IAS 37); Balance at 31 Dec 2020 -672,000 0 0 -672,000

Carrying amount

• Reform of reference interest rates – Phase 2 (amendments to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16);

Balance at 1 Jan 2020 354,836 74,629 0 429,465

• Adjustment of rents with respect to COVID-19 (amendments to IFRS 16);

4

Balance at 31 Dec 2020 384,678 12,005 0 396,683

• Property, Plant and Equipment: Proceeds before Intended Use (amendments to IAS 16);

• Reference to the conceptual framework (suggested amendments to IFRS 3);

Movement in intangible assets for 2019

• Classification of liabilities as current or non-current (amendments to IAS 1)

• IFRS 17 insurance Contracts and amendments to IFRS 17 Insurance Contracts. Long-term Intangible assets Other intangible

in EUR property rights in acquisition assets Total

2.4 Disclosures to the items of financial statements Purchase cost

Balance at 1 Jan 2019 807,650 13,230 6,665 827,545

2.4.1 Intangible assets Additions 62,451 61,399 0 123,850

Disposals 0 0 -6,665 -6,665

Balance at 31 Dec 2019 870,101 74,629 0 944,730

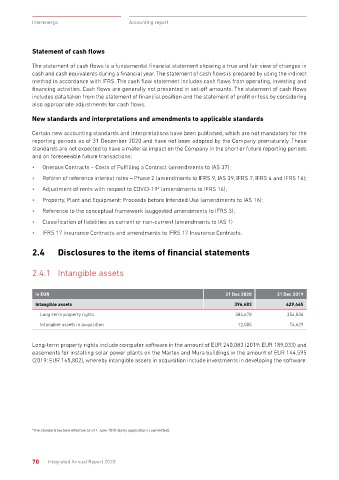

in EUR 31 Dec 2020 31 Dec 2019

Accumulated amortisation

Intangible assets 396,683 429,465

Balance at 1 Jan 2019 -387,774 0 0 -387,774

Long-term property rights 384,678 354,836

Amortisation -127,491 0 0 -127,491

Intangible assets in acquisition 12,005 74,629

Balance at 31 Dec 2019 -515,265 0 0 -515,265

Carrying amount

Long-term property rights include computer software in the amount of EUR 240,083 (2019: EUR 189,033) and

easements for installing solar power plants on the Martex and Mura buildings in the amount of EUR 144,595 Balance at 1 Jan 2019 419,876 13,230 6,665 439,771

(2019: EUR 165,802), whereby intangible assets in acquisition include investments in developing the software. Balance at 31 Dec 2019 354,836 74,629 0 429,465

4 The standard became effective as of 1 June 2020 (early application is permitted).

70 Integrated Annual Report 2020 Integrated Annual Report 2020 71