Page 63 - InterEnergo - Annual Report 2020

P. 63

Interenergo Accounting report Interenergo Accounting report

The Company recognizes the transition between levels at the end of the accounting period in which the change Property, plant and equipment

was made.

Property, plant and equipment are recorded at cost less accumulated depreciation and accumulated impairment

Further disclosures about the assumptions used in measuring fair values are included in the following notes:

loss. The cost of an asset comprises costs that are directly attributable to the purchase of an item of asset.

• Note 2.5.6 – fair values of financial instruments. The cost model is applied for subsequent measurement of property, plant and equipment.

Assets under construction are transferred to property, plant and equipment when they are ready for their

2.3 Company’s fundamental accounting policies intended use.

Gains or losses arising from the disposal or disposal of property, plant and equipment are defined as the

Accounting policies that are outlined below were consistently applied in all periods presented in the accompanying difference between the net realizable value and the carrying amount of the asset and are recognized in profit

financial statements. Certain reclassifications of amounts within individual items were carried out in some or loss on the date of disposal or disposal.

cases. Accordingly, also amounts in the comparative periods were reclassified due to comparability purposes.

The straight-line method of depreciation is applied with property, plant and equipment in their useful life,

without considering their residual value.

Foreign currencies

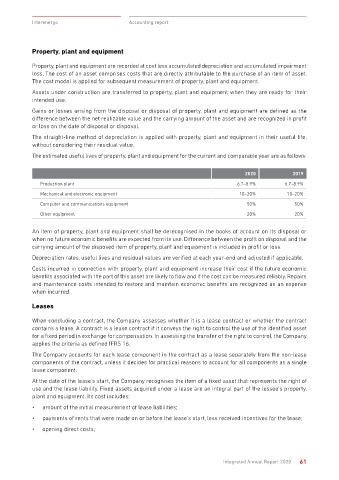

The estimated useful lives of property, plant and equipment for the current and comparable year are as follows:

Transactions expressed in a foreign currency are translated into the functional currency at the reference

exchange rate of the ECB as at the date of transaction. Assets and liabilities expressed in a foreign currency at 2020 2019

the end of the reporting period are translated into the functional currency at the then applicable reference rate

of the ECB. The foreign currency exchange gain or loss on monetary items is the difference between amortised Production plant 6.7–8.9% 6.7–8.9%

cost in the functional currency at the beginning of the year, adjusted for effective interest and payments during Mechanical and electronic equipment 10–20% 10–20%

the year, and the amortised cost in foreign currency translated at the exchange rate of the ECB at the end of the Computer and communications equipment 50% 50%

year. Non-monetary assets and liabilities denominated in foreign currencies that are measured at fair value

are retranslated to the functional currency at the exchange rate of the ECB at the date that the fair value was Other equipment 20% 20%

determined. Foreign exchange differences are recognised in profit or loss.

An item of property, plant and equipment shall be derecognised in the books of account on its disposal or

Intangible assets when no future economic benefits are expected from its use. Difference between the profit on disposal and the

carrying amount of the disposed item of property, plant and equipment is included in profit or loss.

The item of intangible assets includes primarily payments for developing software and easements.

Depreciation rates, useful lives and residual values are verified at each year-end and adjusted if applicable.

Purchase cost includes costs that are directly attributable to the acquisition of an item of property, plant and

equipment. The cost model is used for the subsequent measurement of intangible fixed assets. The Company Costs incurred in connection with property, plant and equipment increase their cost if the future economic

has no intangible assets with an indefinite useful life. benefits associated with the part of this asset are likely to flow and if the cost can be measured reliably. Repairs

and maintenance costs intended to restore and maintain economic benefits are recognized as an expense

Subsequent expenditure on an intangible asset is recognized in the carrying amount of the asset if it is probable when incurred.

that future economic benefits associated with the item will flow to the company and the cost of the item can

be measured reliably. All other expenses are recognized in profit or loss as an expense when incurred. Leases

The straight-line method of amortisation is applied with intangible assets in their useful life, without considering When concluding a contract, the Company assesses whether it is a lease contract or whether the contract

the residual value.

contains a lease. A contract is a lease contract if it conveys the right to control the use of the identified asset

The estimated useful lives for the current and comparable year are as follows: for a fixed period in exchange for compensation. In assessing the transfer of the right to control, the Company

applies the criteria as defined IFRS 16.

2020 2019 The Company accounts for each lease component in the contract as a lease separately from the non-lease

Software 25% 25% components of the contract, unless it decides for practical reasons to account for all components as a single

lease component.

Easement 6.7% 6.7%

At the date of the lease’s start, the Company recognises the item of a fixed asset that represents the right of

use and the lease liability. Fixed assets acquired under a lease are an integral part of the lessee’s property,

An item of intangible asset shall be derecognised in the books of account on its disposal or when no future

economic benefits are expected from its use. Difference between the profit on disposal and the carrying amount plant and equipment. Its cost includes:

of the disposed intangible asset is included in profit or loss. • amount of the initial measurement of lease liabilities;

Amortisation rates, useful lives and residual values are verified at each year-end and adjusted if applicable. • payments of rents that were made on or before the lease’s start, less received incentives for the lease;

• opening direct costs;

60 Integrated Annual Report 2020 Integrated Annual Report 2020 61